Turn employee wellness into lasting retention and real "tax savings.”

BullMight helps service businesses with 50–500 employees cut costs and protect profit. Our Profit Protection Program™ combines AI automation (to reduce payroll overhead by 20%) with W.I.M.P.E.R. tax strategies (to recover one payroll cycle every year). One simple system to lower costs, increase efficiency, and protect your bottom line.

Let BullMight show you payroll inefficiencies and tax overpayments so you can focus on what really matters: growing your business, retaining your people, and keeping more profit in your pocket.

How We Protect Your Profit

Wellness Program – Reduce Taxes, Retain Top Talent

Cut Costs and Strengthen Retention with Wellness

BullMight’s Wellness Program transforms employee benefits into measurable business gains. By offering structured wellness support, you reduce tax liability, ease financial pressure, and give your team a reason to stay loyal and engaged. The result: lower costs, stronger culture, and more focus on growth.

• Unlock safe, proven tax savings

• Retain top-performing employees longer

• Improve morale and reduce absenteeism

W.I.M.P.E.R. – Recover One Payroll Back

Unlock hidden tax credits and recover one full payroll cycle per year

Guide families from first contact to enrolled students.Most businesses unknowingly overpay taxes every year. With W.I.M.P.E.R., we uncover missed credits and deductions, putting real money back in your business. On average, companies see $1,100 per employee in savings — the equivalent of one full payroll cycle recovered annually.

• Identify missed credits & deductions your CPA might overlook

• Save ~$1,100 per employee annually

• Recover the equivalent of one payroll cycle every year

• Guaranteed compliance & savings transparency

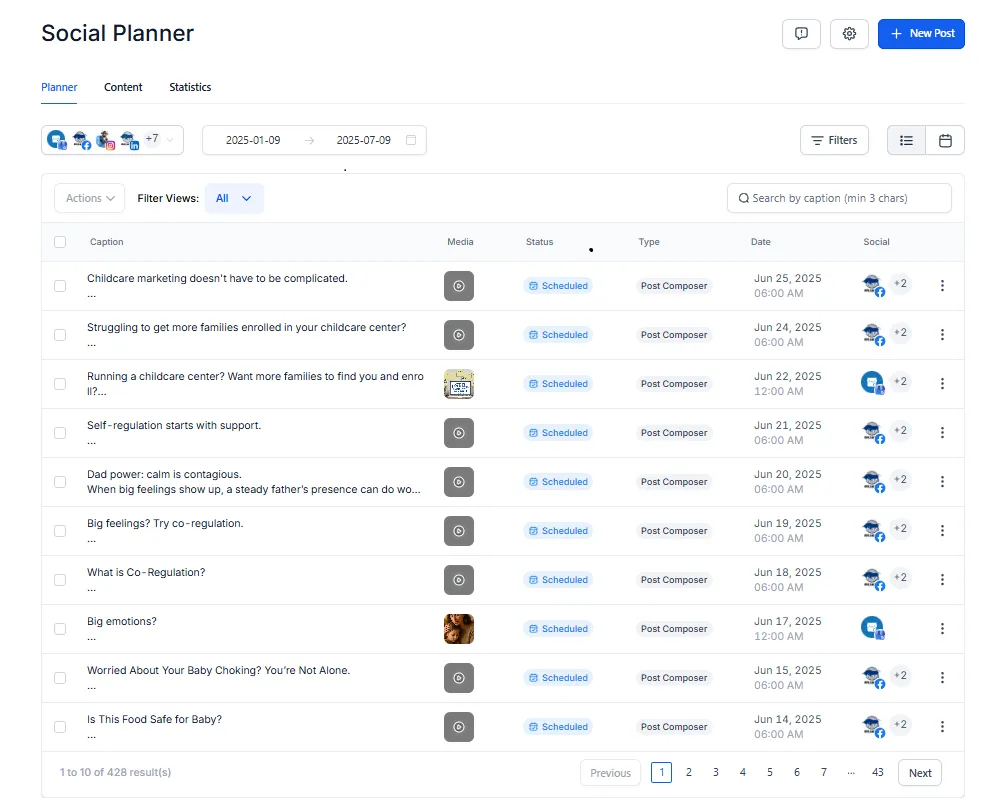

Continuous Monitoring – Stay Efficient All Year

Never lose profit to wasteful spending again

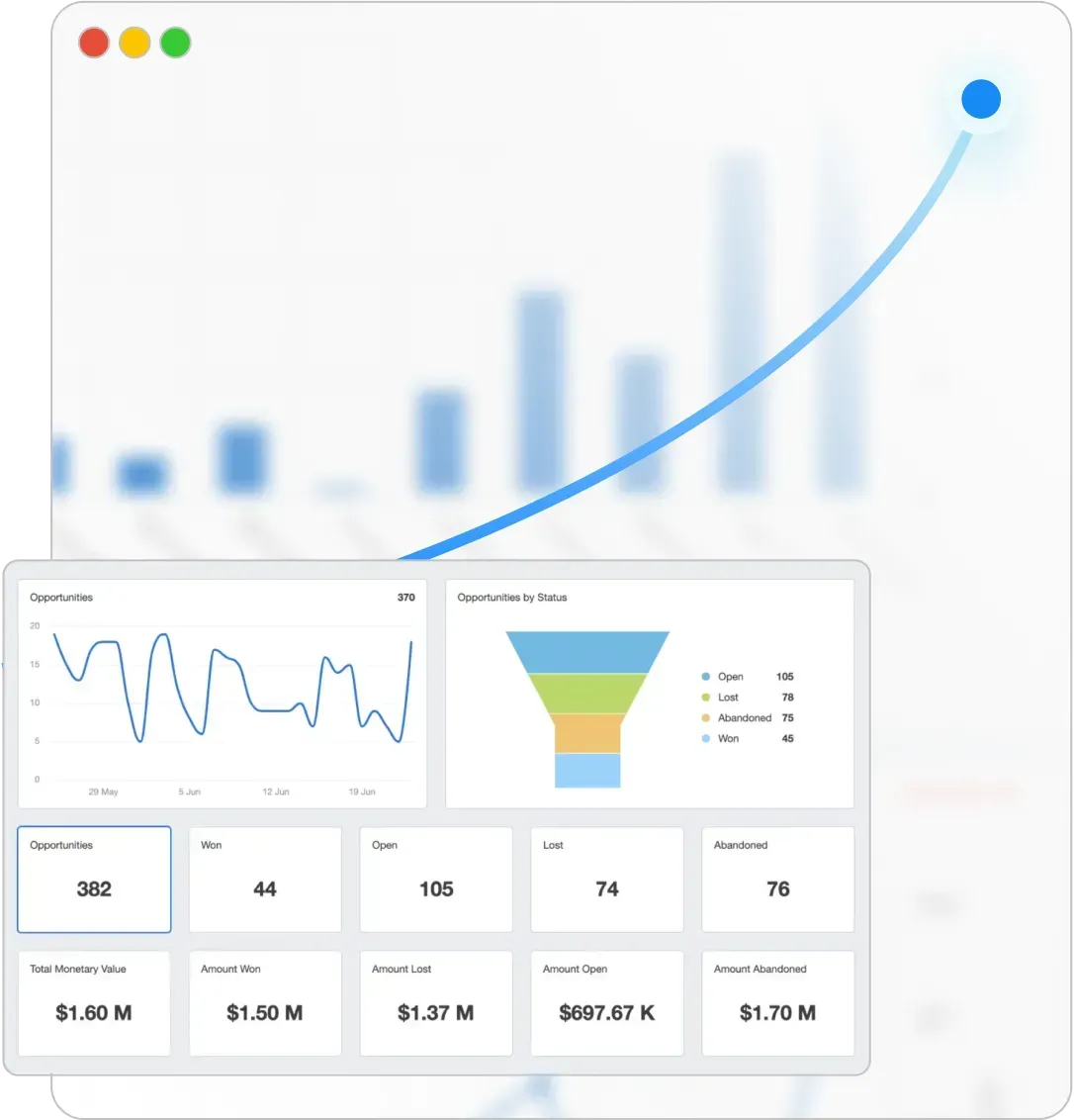

We don’t just set up AI automation and W.I.M.P.E.R. tax savings and walk away — we continuously monitor your business operations. With monthly reviews, profit dashboards, and compliance checks, we ensure your savings keep compounding, not slipping through the cracks.

• Monthly profit protection reviews

• Ongoing AI agent optimization

• Tax savings compliance monitoring

• Transparent reports and dashboards

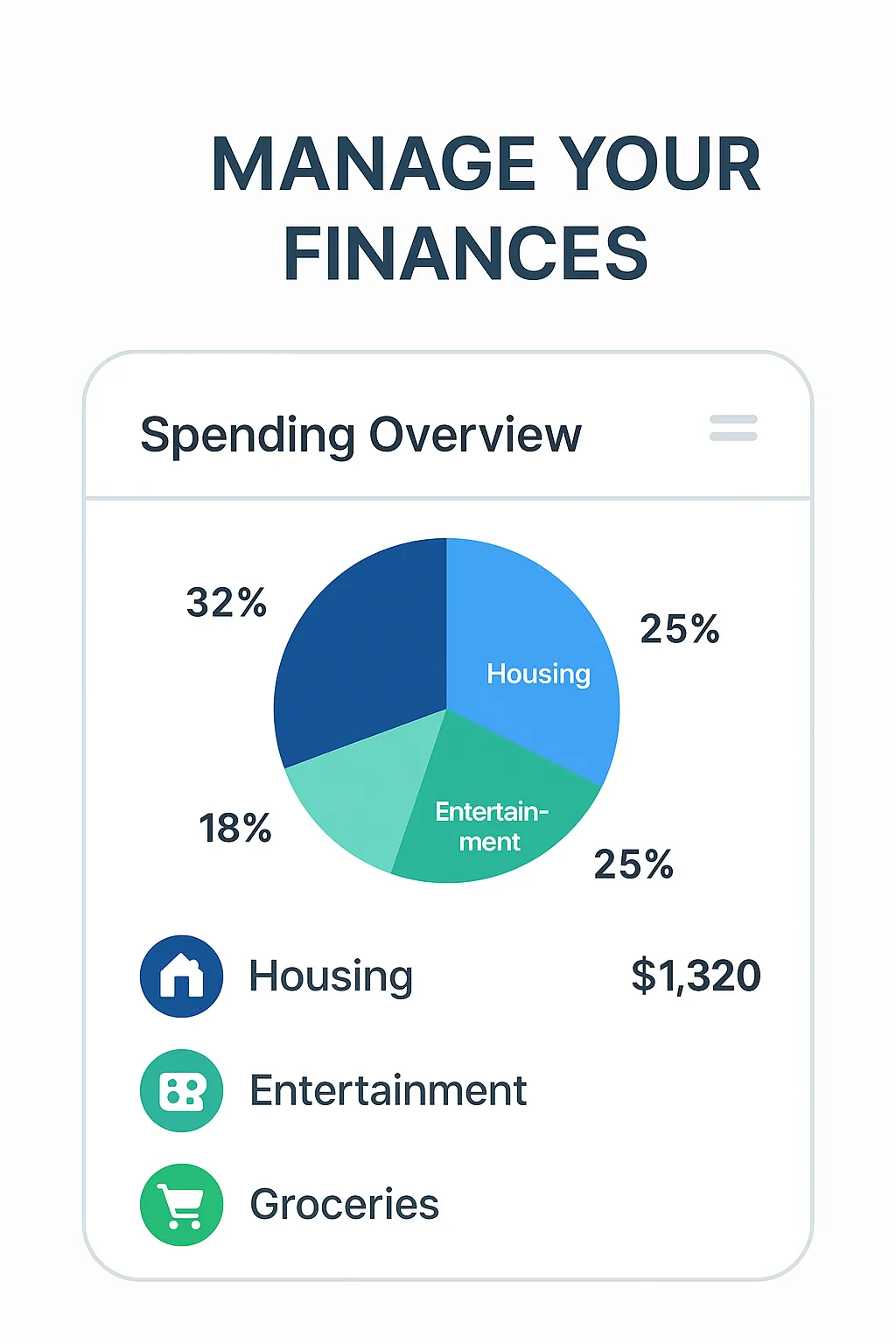

Profit Dashboard – Track Your Savings in Real Time

Real-time visibility into payroll savings and tax recovery

Our Profit Dashboard gives you a clear view of your business efficiency. Track how much AI automation is saving on payroll, see your W.I.M.P.E.R. tax recovery totals, and monitor your ROI month by month — all at a glance..

• Track payroll savings (AI automation impact)

• Monitor annual tax recovery totals (W.I.M.P.E.R.)

• View 20–30% profit savings in real time

• Export transparent reports for your CFO or leadership team growth, and more

AI + Tax Integration – Maximum Efficiency

Seamlessly connect AI automation with tax savings strategies

The real savings happen when your systems talk to each other. We integrate your AI agents, CRM workflows, and W.I.M.P.E.R. tax strategies into one seamless process — giving you maximum efficiency and measurable ROI.

• Integrate AI automation with your CRM

• Connect payroll + tax savings into one dashboard

• Eliminate data silos for accurate reporting

• Maximize efficiency across operations + finances

Industry Report

2025 Business Efficiency & Profit Protection Report

In this exclusive report, uncover data from a 2024–2025 survey of service-based businesses on how they’re protecting profit in uncertain times. Learn the strategies companies are using to reduce overhead, save on taxes, and streamline operations. Inside, you’ll find insights on:

• Cutting payroll overhead with AI automation

• Recovering missed tax savings and credits

• Improving financial stability with profit protection

• Integrating AI + CRM systems for efficiency

• Reducing turnover through wellness programs

• Leadership perspectives on cost-saving strategies

BullMight Support is With You Every Step.

From your first 30-minute profit review to full rollout of AI automation, W.I.M.P.E.R. tax strategies, and CRM optimization — we provide hands-on guidance and ongoing support so your savings and efficiency never stop.

Access our support portal anytime for expert help, training, and resources on your Profit Protection Program™.